Bond duration formula

The DURATION function one of the Financial functions returns the Macauley duration for an assumed par value of 100. The formula for Modified Duration can be calculated by using the following steps.

Seo2 Molecular Geometry Shape And Bond Angles Selenium Dioxide Molecular Geometry Molecular Molecules

Modified duration is another popular method of calculating bond duration.

. Macaulay Duration 607934 1000 607934. Annual coupon rate is 6. Frac Macaulay Duration 1frac YTM Annual Payments 1 Annual P aymentsY TM M acaulay Duration.

Here is a summary of all the components that can be used to calculate Macaulay duration. M Number of payments per period 2. Now we will upgrade the formula and add the convexity adjustment to it.

The formula used to calculate a bonds modified duration is the Macaulay duration of the bond divided by 1 plus the bonds yield to maturity divided by the number of coupon. N Years to maturity. The percentage change of the bond price equals -1 times modified duration times yield change.

The formula for calculating duration is. Calculation of Macaulay Duration will be. You can refer given excel.

Bond price is 9637. It measures the price sensitivity of a bond when there is a change in yield to maturity. Therefore for our example m 2.

The formula for calculating dollar. Bond face value is 1000. Firstly determine the YTM of the security based on its current market price.

Current Bond Price PV of all the cash flows 607934. For a standard bond with fixed semi-annual payments the bond duration closed-form formula is. FV par value C coupon payment per period half-year i discount rate per period half-year a fraction of a period remaining until next coupon payment.

C Present value of coupon payments. Based on the above information here are all the components needed in order to. T Each year until maturity.

Duration is defined as the weighted average of the present value. The modified duration formula is. Duration measures the bonds sensitivity to interest rate changes.

Duration and convexity are two tools used to manage the risk exposure of fixed-income investments.

Nocl Lewis Structure Nitrosyl Chloride Math Lewis Molecules

Duration In Investing How It Works Types And Strategy Investing Strategies Cash Flow

Chemsolve Net Physical Chemistry Molecular Organic Chemistry

Types Of Organic Chemistry Formula Poster By Compound Interest Chemistry Basics Chemistry Lessons Science Chemistry

Here Is What I Ve Been Compiling As The Hardest To Learn Formulas For The Memorization Phase Not Surprising How To Memorize Things Formula Forensic Accounting

Covalent Bond Covalent Bonding Chemical Bond Water Molecule

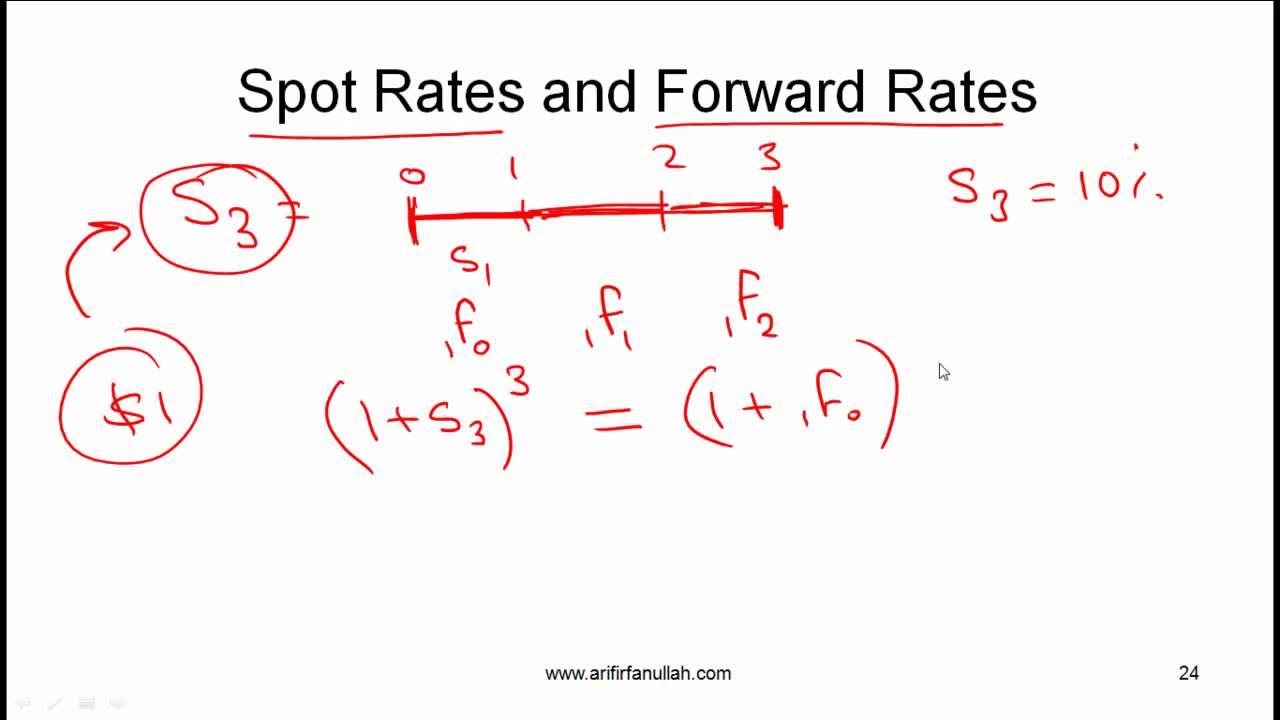

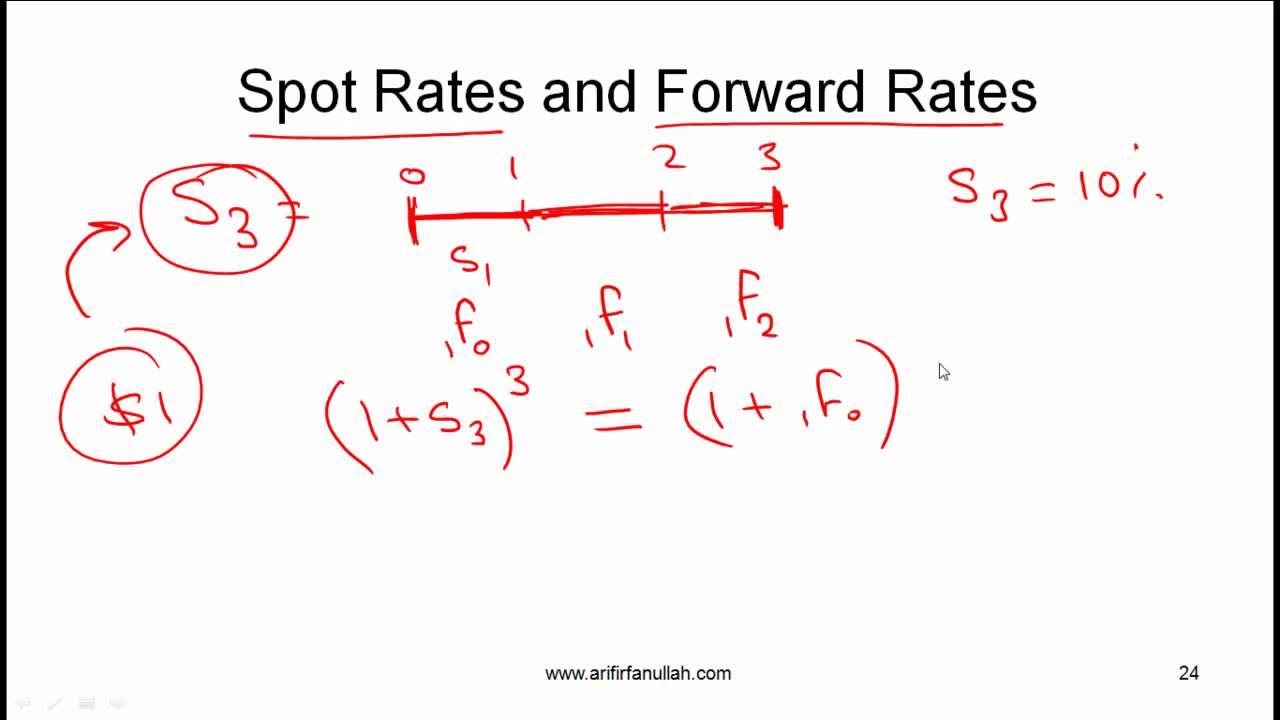

Cfa Level I Yield Measures Spot And Forward Rates Video Lecture By Mr Arif Irfanullah Part 5 Youtube Lecture Mr Video

What Is A Product In Chemistry Definition And Examples Chemistry Definition Chemistry What Is A Product

Bond Price Calculator Online Financial Calculator To Calculate Pricing Valuation Of Bond Based Financial Calculator Financial Calculators Price Calculator

Ammonium Chloride Nh Cl Molecular Geometry Hybridization Molecular Weight Molecular Formula Bond Pairs Lon In 2022 Molecular Geometry Molecular Infographic

Formula Unit Easy Science Easy Science Science Rules Ap Chemistry

Must Know Cfa Formulas Business Insider Fisher College Of Business Business Insider Formula

Degrees Of Unsaturation Or Ihd Index Of Hydrogen Deficiency Chemistry Index Organic Chemistry

Types Of Organic Chemistry Formula Poster By Compound Interest Organic Chemistry Study Chemistry Basics Chemistry Lessons

Prove The Infinite Geometric Series Formula Sum Ar N A 1 R Geometric Series Series Formula Studying Math

How To Calculate The Yield Of A Zero Coupon Bond Using Forward Rates Bond Calculator Really Cool Stuff

Effective Interest Rate Formula Interest Rates Accounting And Finance Rate